When I was working on a personal carbon footprint tracker with Cogo, I spent a lot of time looking at banking apps. Cogo used Open Banking to pull over users day to day transactions and then assigned each transaction a carbon footprint. I was pretty surprised at how much variety there was in banking app quality.

I’m going review some banking apps, earning a little money from account switching offers as I go. I currently use Starling: having always used ethical banks like coop and Triados before I moved to Starling because I was struggling to budget and manage my money. I’ve come out the other end of that journey feeling a lot more in control of my finances, however, and I’m interested to see if any other banks can beat starling with a great app.

Table of Contents

Starter account with Monzo

I already had a Monzo account open with some money in so I decided to start here. I collected £5 referral bonus for referring my brother, and set up a few direct debits, switching my Paypal, Labour Party membership and Youthhostel membership over to this account. Now I am ready to switch.

Why I quit Monzo

There is a single reason I quit Monzo and stuck with Starling: Monzo regularly prompts me to get into debt, with push notifications about loans for example.

I don’t want any more debt and I found getting prompts to borrow money when I’m on maternity leave and totally skint pretty annoying tbh. They also have options like remortgaging deals in the banking app, it seems like Monzo functions like a credit ratings and offers app (such as Credit Karma) merged with a current account service.

I just like to keep these things separate so I’m not looking at long term financial decisions while making short term decisions in my day to day spending.

Things I love

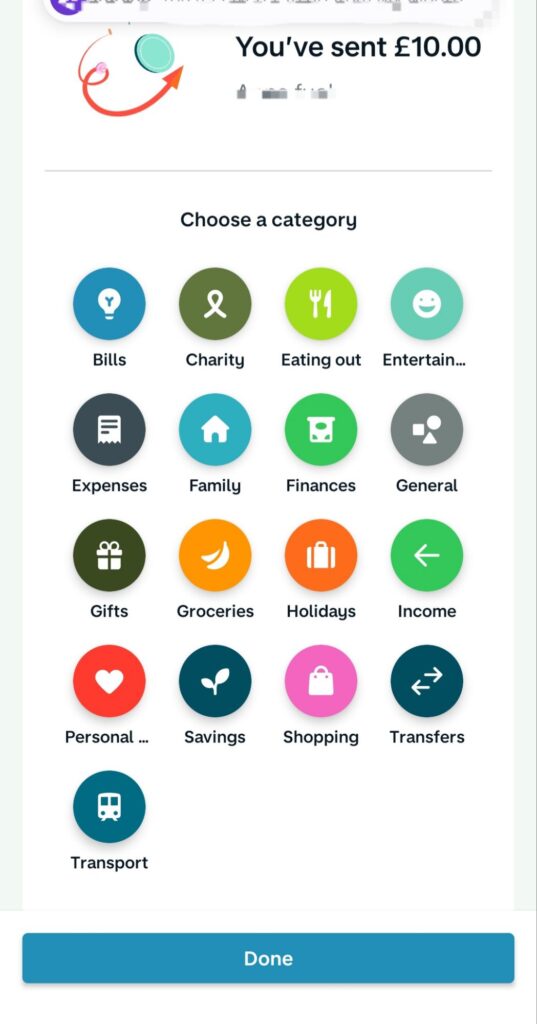

Categorization prompts

I like the option to categorize a payment immediately after making the payment, that’s really helpful. In Starling by comparison, payments are just categorized as “payments” when they could be e.g. savings, childcare, entertainment. You can go and categorize them manually and apply this to all, it’s not prompting you to keep that habit

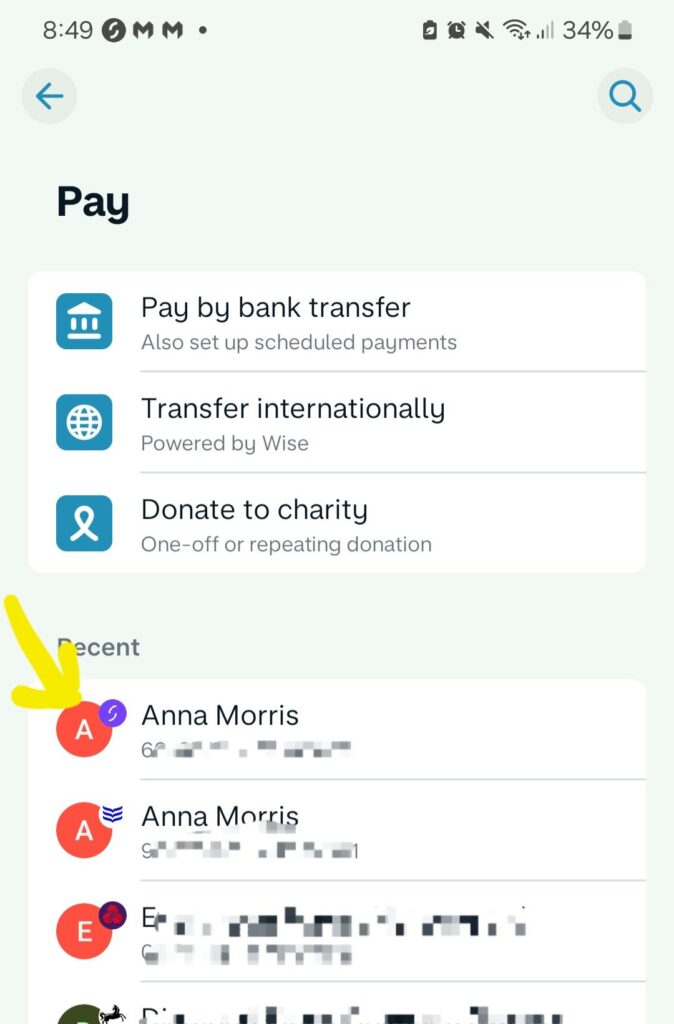

Bank logos

I also like that the Logo of receiving bank is shown in list of saved recipients, this helps me find what I’m looking for more quickly.

Savings pots (comparison to starling)

I use savings pots in Starling really (really!) extensively. I use them like cash envelopes, and in fact I used them so much in the past year or so I realized recently I was getting a very bad deal on interest.

Monzo and Starling encourage you to keep your savings in your current account, offering low rates like 3.54% and 3.25% respectively but amazing features for ringfencing your money. I’ve not found a savings account with good interest that let’s me ringfence money that way yet.

I’ve used my Starling pots to save for thing like:

- car insurance

- keeping 3 months of mortgage payments in reserve

- extra food money for the summer holidays

- kids shoes

- Christmas

- repaying debts

I even pay all my bills from a savings pot because in starling you can

- Set up a virtual debit card attached to a pot so money comes from that (Monzo offer this but you have to update to “Perks” for £3+ per month)

- Specify particular direct debits to come out of a pot (also available in Monzo for free)

Monzo pots are more comprehensive, with

- Regular pots for bills

- Savings pots, the interest rate is specified which is great

- Safety net pots, which is what I have manually done instarling with mortage buffer and summer holiday food etc.

- Investment pots, which I have similar feelings about to the debt stuff

- Ability to lock a pot so it’s harder to access, which I like

This said, I like how simple starling is, I just wish they had better interest!

General UI complexity and options galore

I find Monzo app UI a bit complicated, there is a lot going on compared to a standard current account with options like splitting the bill, creating a tab, cashback offers, investments, loans etc. I never really liked the budgeting UI in particular, it’s just too complicated. Starling also has this feature but it’s on a sepearte tab from transactions list so I just don’t look at it, where as for Monzo the payments are all on the trends tab.

I think the Monzo budget feature probably quite useful if you have more money coming in than you need for basics, and it comes in on a regular basis. I’m not in that situation, as a freelancer money is unpredictable and as a single mum of two on maternity leave, I’m usually just trying not to run out of money for basics rather than trying to cut down on stuff I can do without. So the budgeting feature isn’t really for me anyway and I can’t offer much of a review.

So, for now, farewell Monzo and hello Coop!

Ps: I had some statements to download later and found monzo barley has any online banking facilities. You can log in and see transactions but if you want statements it’s mobile only as of December 2024. That said you can download a single statement covering custom date range like a whole year so it’s not as big a deal as downloading loads of files on your phone if you need several months. Still a bit irritating tbh.