In this series of blogs I am reviewing banking apps and earning a little money from account switching offers as I go. I used to struggle to manage my money but I now have a lot more control over my finances thanks to Starling’s banking app. I’m interested to see if any other banks can beat Starling and am also a banking app nerd anyway – let’s dive in!

The first blog in this series featured Monzo. Can Co-op do better? I’ve banked with them in the past and moved away because the didn’t have great features. Now they want my custom again, let’s see how they do!

Table of Contents

A tough review

I have a lot of respect for ethics and ethos of the Co-op bank and in general I am a principled and ethical consumer. However with two kids relying on me I can’t afford not to stay on top of my finances and the Co-op bank just doesn’t offer me anything to make that easier. But let’s start with the good stuff first.

Ethical Policy

Front and centre of the Co-op Bank website is a section on their values and ethics.

“By choosing us, you’re choosing to withdraw from the financing of fossil fuels, oppressive regimes, unethical labour practices, and so much more.”

Here are some examples of where The Co-op won’t invest, loan money or provide banking services:

- The exploration, extraction or production of fossil fuels or related infrastructure

- The manufacture of chemicals that are persistent in the environment, bio-accumulative or linked to long-term health concerns

- The unsustainable harvest of natural resources, including timber, fish and palm oil

- Animal testing, intensive farming, blood sports, the fur trade or exotic leather

- Manufacture or transfer of indiscriminate weapons, torture equipment or any company that has business relationships with an oppressive regime

- Gambling

- Pay-day loans

- Any company or organisation takes an irresponsible approach to the payment of tax

- There are many more – and the source of the list is the customers of the bank

Read the review at Ethical Consumer

My first hand experience of screening

Having previously been a customer of the Co-op business bank I remember the large form I had to fill in with my application. It made sure I was not involved in any of these sectors or activities. Their current screening process is here.

I don’t remember being contacted again about our ethics or being checked up on, however, we were small fry and we also had extensive ethical policies listed on our website for anyone to check.

But there is a huge lack of features

Weighing against all the great stuff ethically is that this banking app is totally lacking in features. The Cooperative Bank values “self-help and self-responsibility” and I firmly believe they should give users tools to manage their money therefore.

Application process

The application process for my account was smooth. I really liked the following:

- Can choose e.g. Mx for title

- Can opt out of overdraft

- Clear opt in or out of marketing preferences

Two issues:

- Can only put male or female under “gender” – not clear that this is needed

- Bug: two middle names with a space between gives an error even though middle name(s) plural is specified

Set-up and transition day

This was all fairly smooth with good communication. The date for my old account to be transferred over was several weeks away however I could choose the date and the communication was clear. However after my application was approved….

They sent me 85g of paper including a paper user manual!! I thought this was ridiculous from an environmental perspective.

Daily use highs and lows

Nice touches

- The app is clean and nice to use

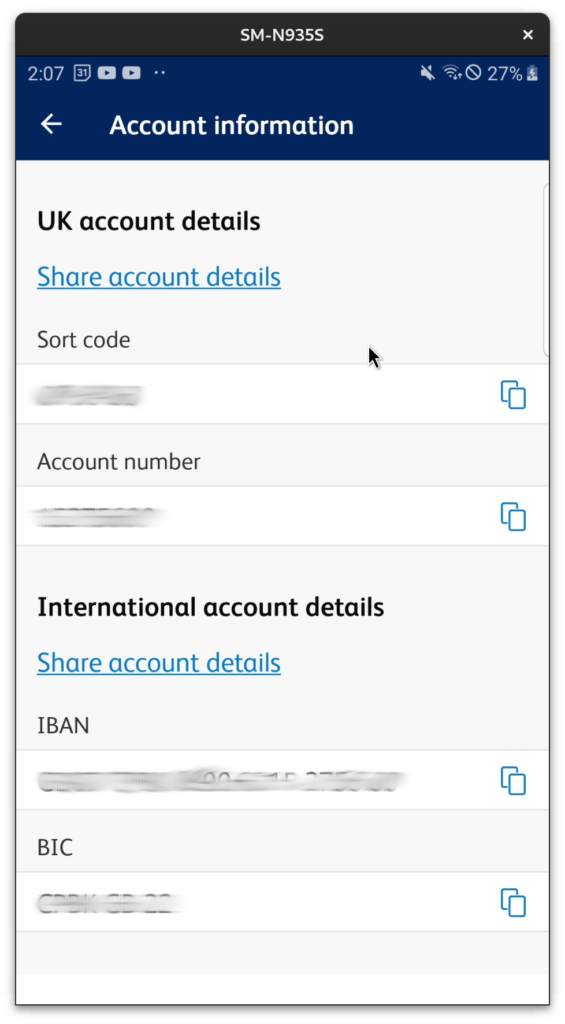

- I can share account details and copy them easily

- I got regular anti-fraud alerts:

- In the app when I open it

- Push notifications about live scams

- if this is as real-time as it seems then they’re doing a great job!

- Easy reporting of scams in the app

- However there is no way to see previous push notifications (Starling has this) so once the scam warning is swiped away I couldn’t check it again

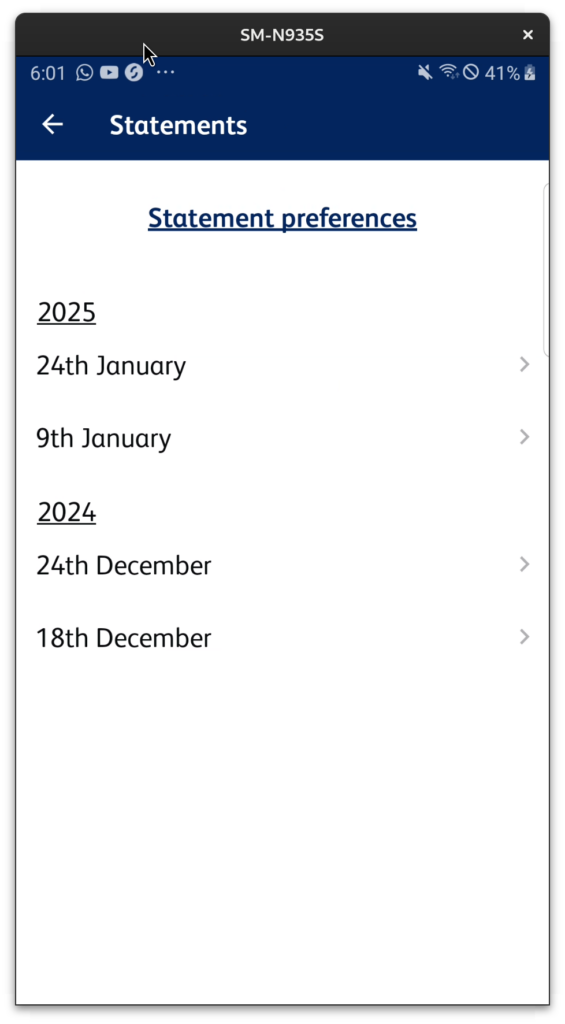

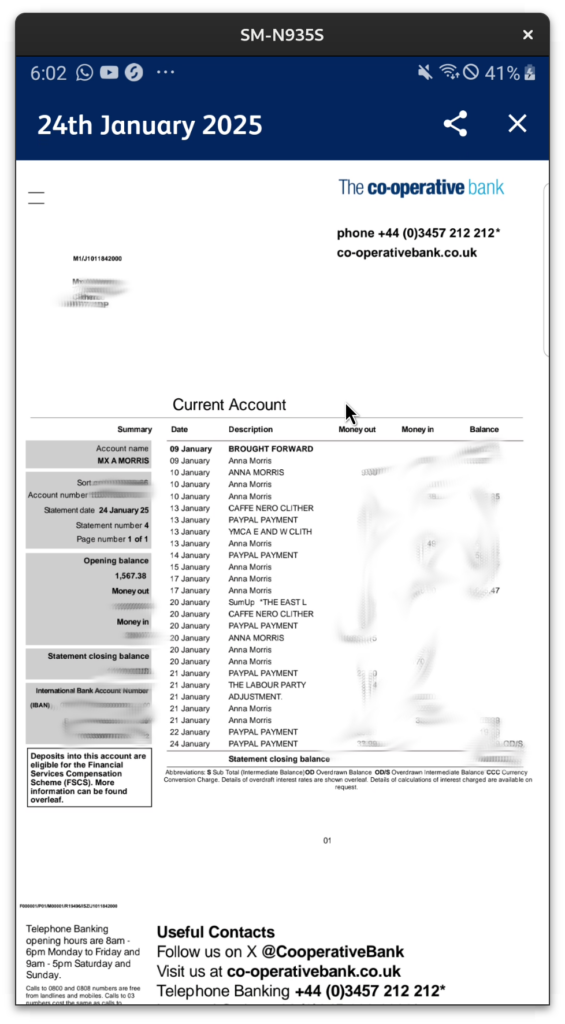

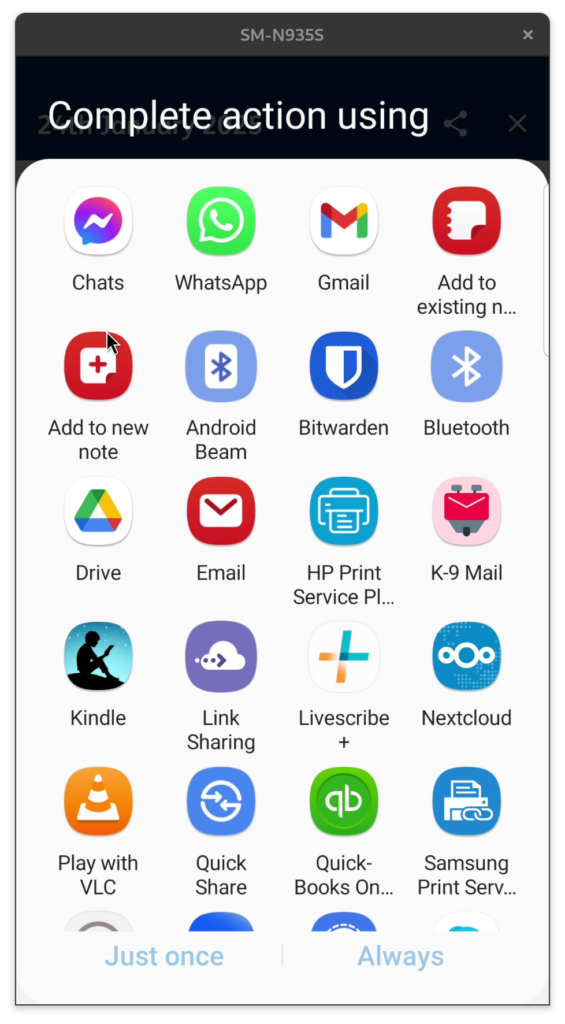

- I can view monthly statements easily. These are standard pdf’s which can be shared, there is no download button unfortunately.

Big problems

Slow and unhelpful transaction data

- I never got notified when money arrived

- Money also didn’t arrive right away

- Took long enough I got bored trying to time it, maybe 10-15 mins?

- Money didn’t leave right away after spending it on card

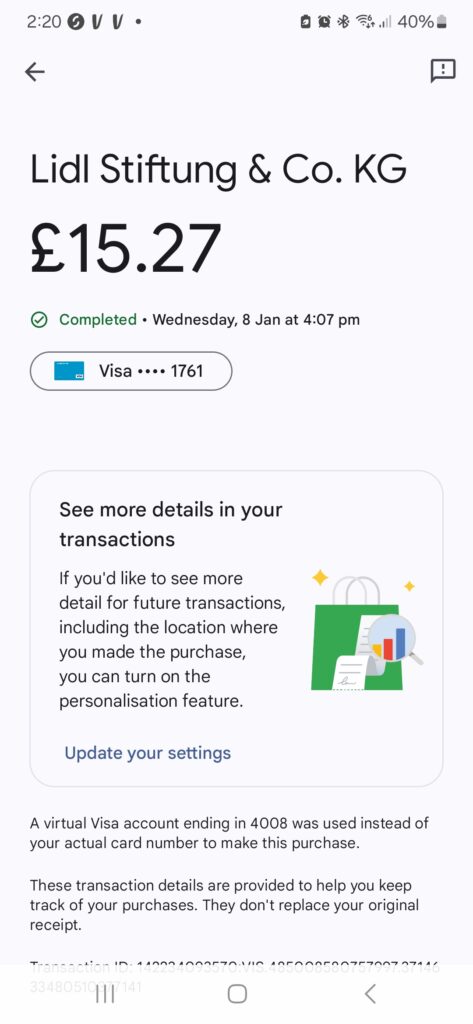

- When I spend money with Google pay it does show in the pending transactions figure and is deducted from the current balance quickly, so I can’t “spend the same money twice” and go overdrawn.

- However the transaction doesn’t show in the list of transactions right away

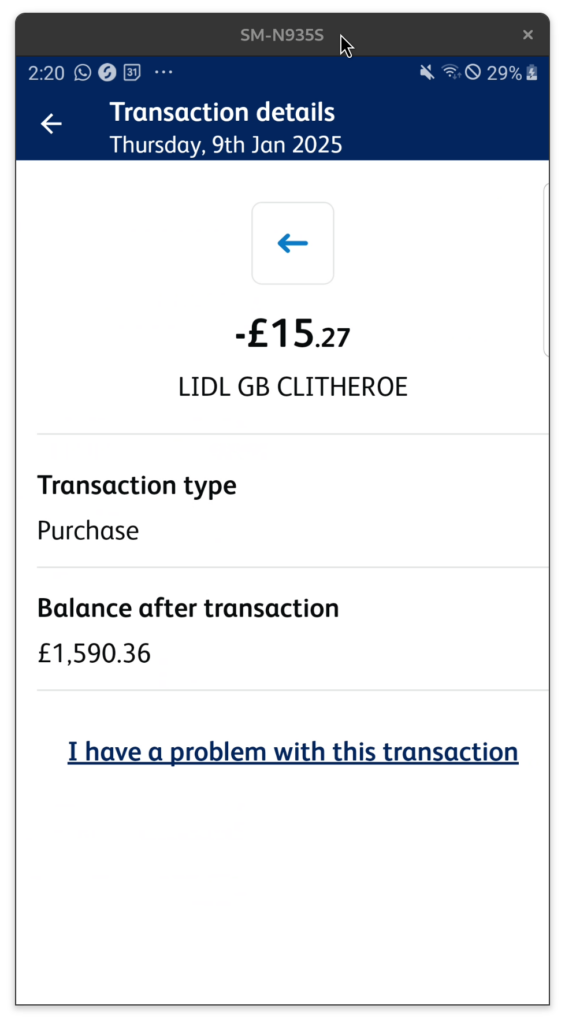

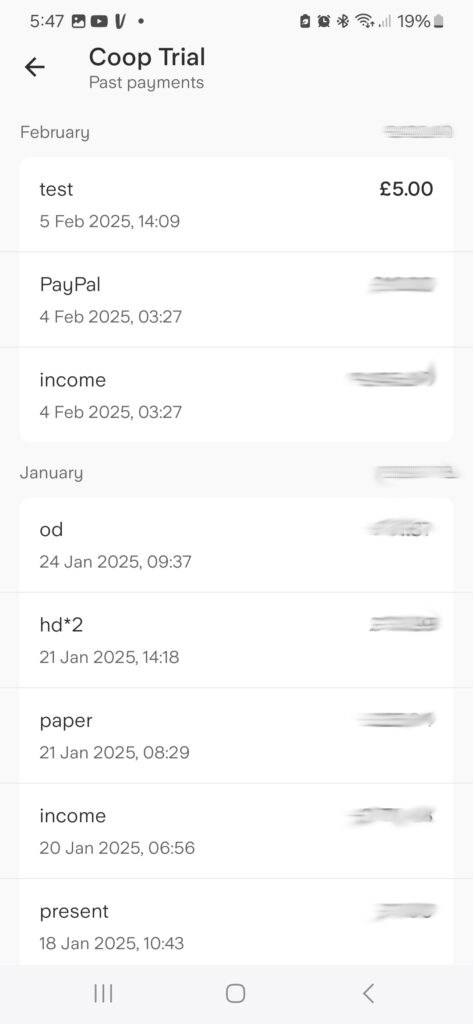

- When it does show there it would show the date it left my account not the date I actually made the payment, which seem often not to be the same

This was a deal-breaker for me, I found it impossible to organise my finances when the date and times on transactions didn’t tally up with my real world activities. Things like recording expenses for work and checking I’m under budget don’t work well when dates are wrong or there is a time-lag.

Also, upcoming direct debits or payments don’t seem to go in the pending payments section. Unlike with Starling, there were no push notifications reminding me of upcoming transactions: I went overdrawn several times.

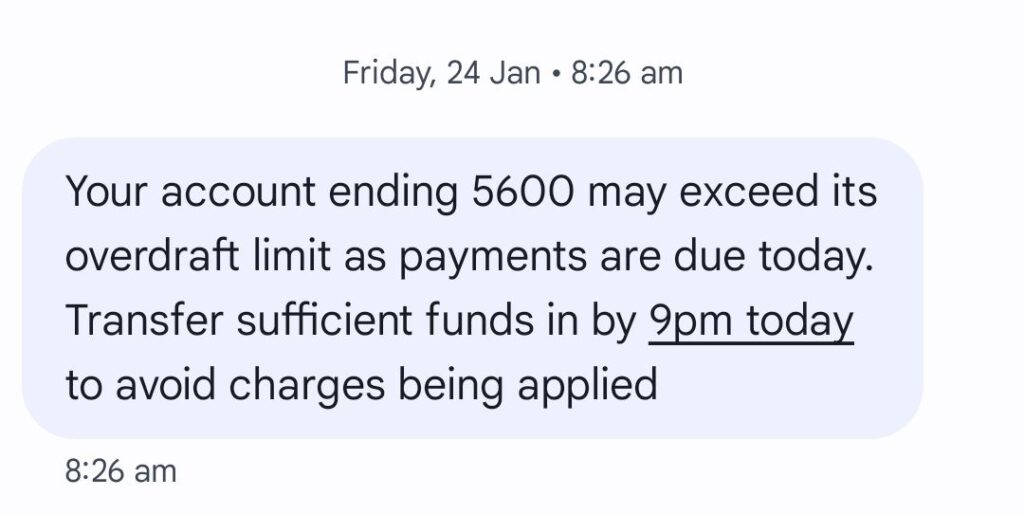

When going overdrawn I would get a vague text message saying my account “may go overdrawn” but I have to go in and check it to see what’s wrong.

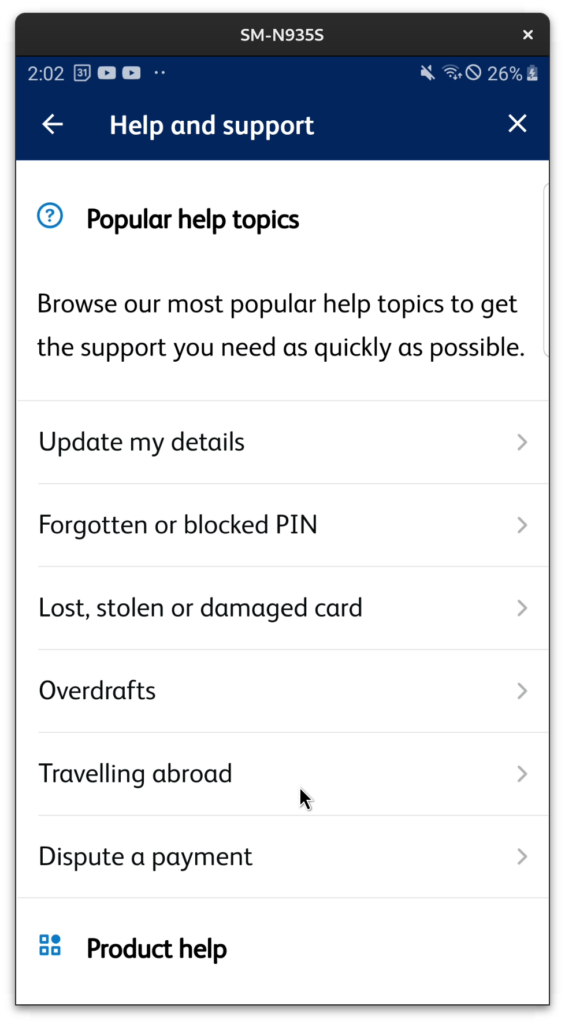

No app help on the app

The help section doesn’t include anything about the app. I had some initial questions, for example:

- my new account isn’t showing in the app

- how to I take screenshots in the app

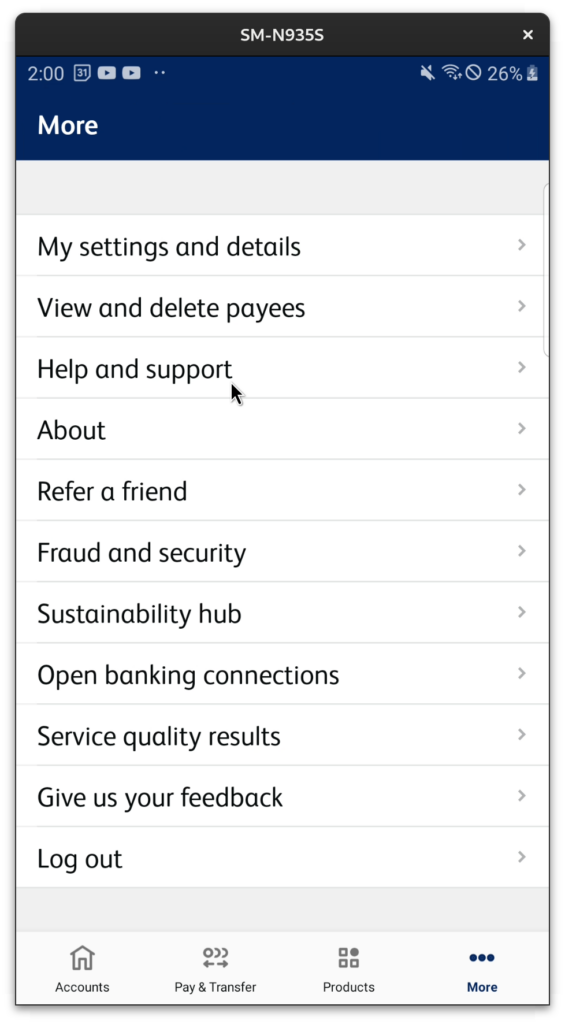

When I go to More and Help and Support like so:

There is no help about using the app, just about general banking issues or new products (accounts, credit cards etc)

These sections load in a webview, so this is just a website with no app help info on it…however oddly, three ARE help guides for their mobile app on the coop website. Bit strange!

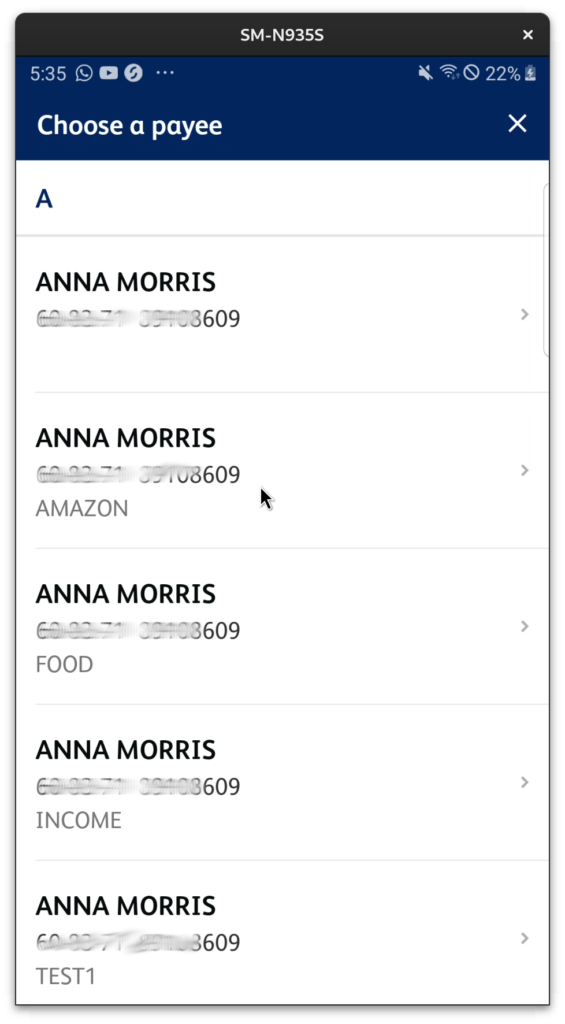

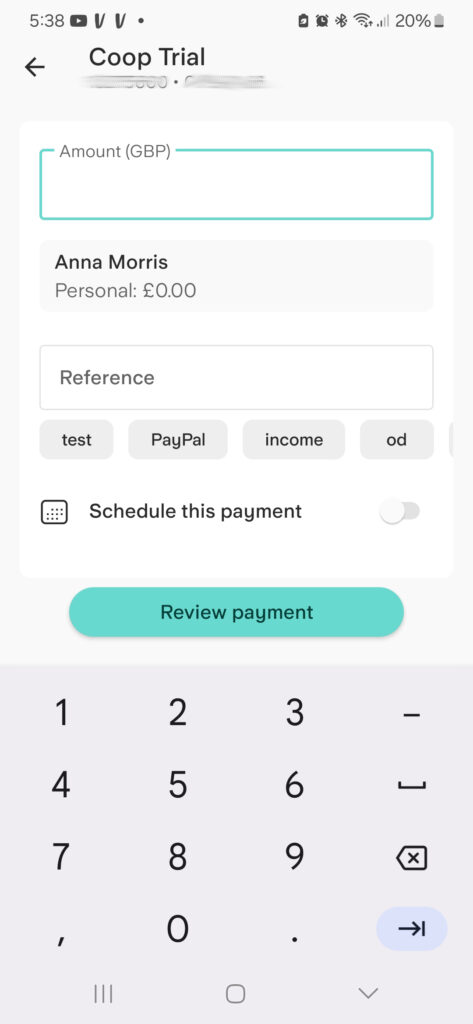

Messy payee duplication

The way payees and payment references work in the Co-op app is particularly poor in my view. A new payee gets generated each time a new payment reference is used – even if the bank details and name are identical and the payee is already listed in the app. Even when I tap an existing payee and made a payment from there with a new reference, a new payee is still created.

I use payment references often to help me remember what payments were for, even if I’m just moving money between my own accounts. Over time I would make very large numbers of these duplicate payees. They can at least be deleted, but still this is a bit of a mess!

In Starling there is a single payee and each reference is saved when I use it the first time. Recent references are suggested when I make a new payment to that payee (each payee has only it’s own references suggested). Then the reference shows up next to the transaction in the transaction feed and also I can see a list of all the transactions and their references by tapping on the payee. It’s just … sensible and useful!

Misc peeves

I was allowed to send a large amount of money to a payee that has been transferred over in the account switch with no security other than having logged in with pin. I thought this was pretty poor when the bank was otherwise good on security.

The Cooperative Bank says “we will help our customers to make sustainable choices, wherever possible, through interactions with our bank” but there is no information given to customers about their purchases. I know from past work that it is possible to assign estimated carbon footprints to purchases for example.

I am fairly sure was not prompted to allow notifications when setting up the app.

I don’t like the Co-op having prizes like the one below, it’s too close to gambling in my view.

Missing features I’d like to see

This the Co-op should be working on to get customers like me to stay:

- Basic tagging/categorising of transactions e.g. groceries, bills, transport etc

- Very simple chart to show total of each tag each month

- Basic ring-fencing system for bills

- Notifications for incoming money and upcoming payments

- Accurate data about transaction date/time

- Fixes to payment reference/payee duplication issue

- Improved documentation/help

- Some kind of ethical consumerism prompt or gamification within the app to help customers reduce their carbon footprint and increase ethical shopping behaviours.

In summary

I will always recommend the Co-op to people who are on top of their money without needing a lot of features or help. Their ethics are great and this matters. However the bank could do so much more to meet it’s aims of financial self help and self responsibility by giving basic tools and help to users wishing to take action daily.

I have decided to leave the Co-op for now, next stop Santander!